The abatement is given at the IRS' discretion, but it is generally given to most taxpayers. It's documented in the IRS' operational manual under their discretionary powers. It's unofficial because it's not required by any statutory tax law or regulation.

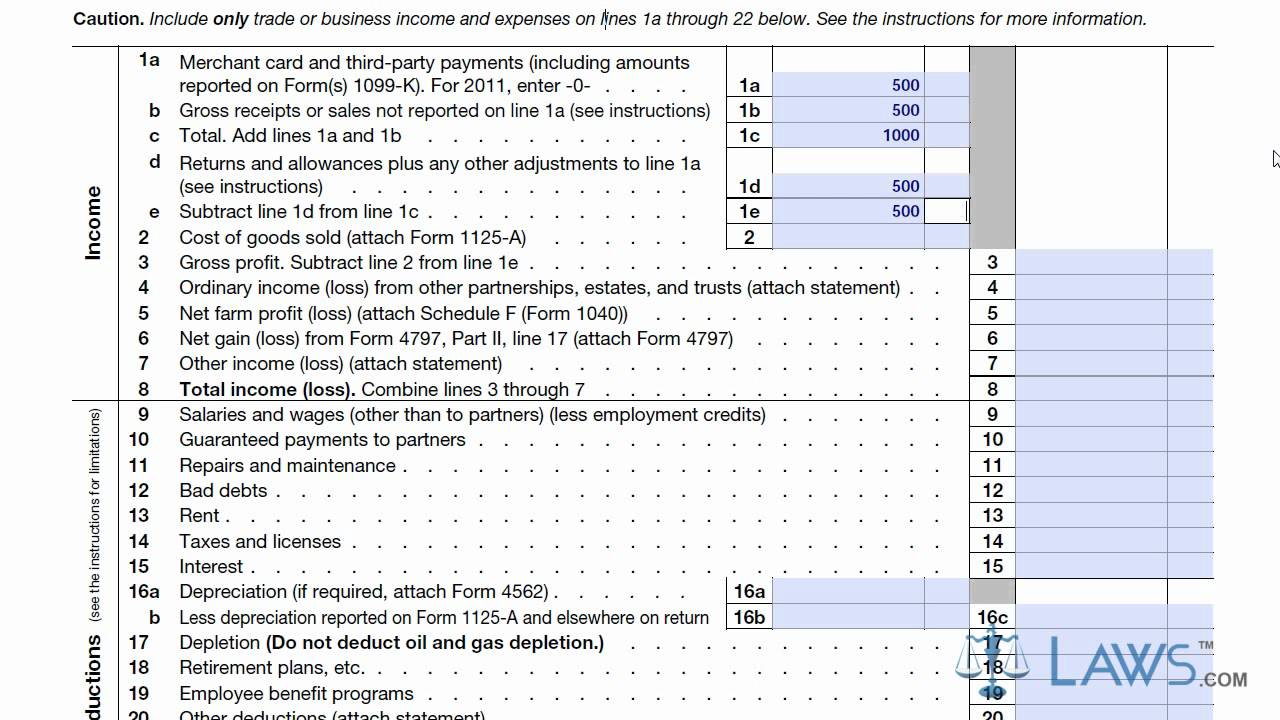

The IRS has an unofficially policy to provide taxpayers with a " first-time abatement" or forgiveness of late penalties. Obviously, that is punishing to any entrepreneur's business, but the IRS does provide us with a silver lining. "Bob, LLC'' owes the IRS $585 dollars in late penalties per month ($195 multiplied by three), which times 10 months equals $5,850 dollars in late penalties, not including interest.

"Bob, LLC'' has three partners and files their tax return 10 months late.

0 kommentar(er)

0 kommentar(er)